Investors and analysts use ratio analysis to evaluate the financial health of companies by scrutinizing past and current financial statements. For example, comparing the price per share to earnings per share allows investors to find the price-to-earnings (P/E) ratio, a key metric for determining the value of a company’s stock. An analyst reviews a company’s income statement to assess its profitability. By comparing revenue, cost of goods sold, and operating expenses over multiple periods, the analyst calculates key profitability ratios, such as the Gross Profit Margin and Net Profit Margin.

Financial Risk Ratio Analysis

- The price-earnings ratio is calculated by dividing the Market price by the EPS.

- The gross margin ratio is calculated as gross profit divided by net sales.

- CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation.

- There are many market value ratios, but the most commonly used are price per earnings (P/E) and dividend yield.

- Market prospect ratios help investors to predict how much they will earn from specific investments.

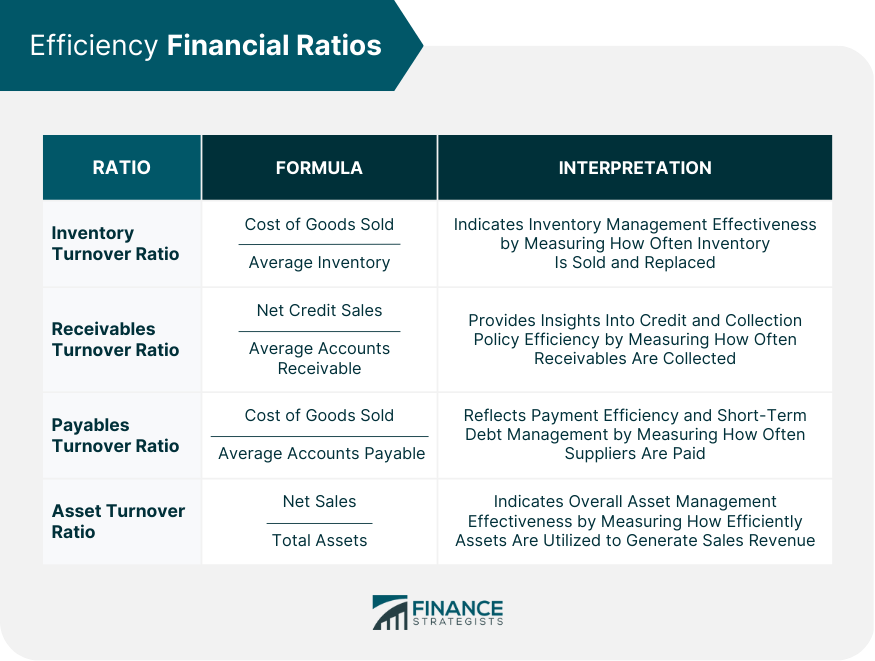

Most importantly, the effectiveness of the analysis depends on the knowledge and experience of the investor. For example, a company can possibly make small adjustments to its financial statements that makes its stock and ratios look better without there being any real effect on its actual financial health. This ratio is also known as the quick ratio as it helps determine a company’s ability to pay off debt using quick assets. Unfortunately, liquidity ratios are not true measure of liquidity because they tell about the quantity but nothing about the quality of the current assets and, therefore, should be used with caution. For a useful analysis of liquidity, these ratios are used in conjunction with activity ratios (also known as current assets movement ratios). Examples of activity ratios are receivables turnover ratio, accounts payable turnover ratio and inventory turnover ratio etc.

What is Ratio Analysis?

• Liquidity ratios, such as the Current Ratio and Quick Ratio, help assess a company’s ability to meet short-term obligations, crucial for evaluating newer firms. When used together, turnover ratios describe how well the business is being managed. They can indicate how fast the company’s products are selling, how long customers take to pay, or how long capital is tied up in inventory. Ratios help an owner or other interested parties develop an understand the overall financial health of the company.

Current opportunities

Horizontal analysis involves comparing financial data across multiple periods to identify trends. For example, an analyst might compare annual sales, expenses, and will i be provided with the proper tax forms net income over a five-year period. If sales show steady growth but operating expenses increase disproportionately, it could indicate operational inefficiencies.

Debt-to-Equity (D/E) Ratio

The resulting ratio can be interpreted in a way that is more insightful than looking at the items separately. If a company has $100,000 in net annual credit sales, for example, and $15,000 in average accounts receivable its receivables turnover ratio is 6.67. The higher the number is, the better, since it indicates the business is more efficient at getting customers to pay up. Investors use average inventory since a company’s inventory can increase or decrease throughout the year as demand ebbs and flows. As an example, if a company has a cost of goods sold equal to $1 million and average inventory of $500,000, its inventory turnover ratio is 2.

Leading a dedicated team of 10 wealth managers Vivek’s leadership and strategic acumen are pivotal in delivering tailored financial solutions and driving client success in wealth management. He is an expert in Wealth management and currently serves as the Assistant Vice President. Ratan Priya is dedicated to supporting clients throughout each phase of their financial journey, offering personalized, strategic counsel focusing on long-lasting success. Manu manages the financial affairs of more than 70 families, specializing in tax, estate, investment, and retirement planning.

Investors often employ financial ratios to analyze the performance and financial health of various stocks. This approach helps them make informed decisions on their investment strategies. By incorporating ratios into their analysis, investors can gain valuable insights into key aspects of a company’s solvency, capital structure, and market positioning. Fundamental analysis focuses on the intrinsic value of a company based on its financial statements and other qualitative factors, such as management structure and corporate governance.

In conclusion, financial ratios are essential tools used in the analysis of a company’s financial statements. They allow investors, analysts, and other stakeholders to evaluate the company’s liquidity, profitability, solvency, and other financial aspects to make informed decisions and assessments. A firm understanding of these ratios can provide valuable insights into the company’s overall financial health and future prospects. Profitability ratios are essential financial tools to evaluate a company’s ability to generate income relative to its revenue, operating costs, balance sheet assets, and shareholders’ equity.