Maximizing Your Profit: The Best Forex Trading Programs

In the ever-evolving landscape of forex trading, having the right tools at your disposal is essential. forex trading programs Best MT4 Platforms can significantly impact your success. With numerous forex trading programs available, selecting the one that aligns with your trading style and goals is critical. This article explores various forex trading programs, their features, and how they can help elevate your trading experience.

What are Forex Trading Programs?

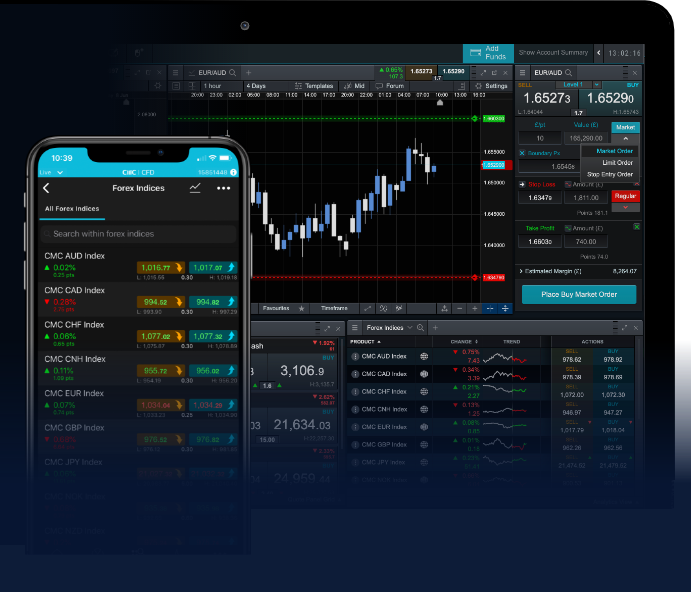

Forex trading programs are software applications designed to facilitate the trading process in the foreign exchange market. These programs come equipped with various features that assist trader decision-making, including real-time data analysis, automated trading capabilities, and advanced charting tools. Whether you are a beginner or a seasoned trader, these programs can streamline your trading efforts and enhance profitability.

Key Features of Forex Trading Programs

When evaluating forex trading programs, several essential features should be considered, including:

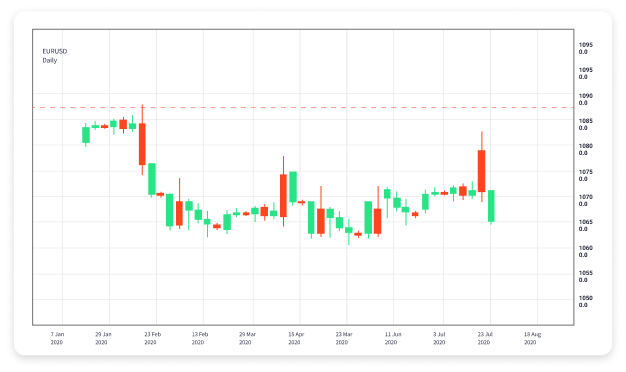

- Charting Tools: The ability to analyze price movements through charts is crucial for traders. Comprehensive trading programs often feature advanced charting tools, customizable indicators, and various time frames to cater to different trading strategies.

- Technical Indicators: The best forex trading programs include a range of technical indicators that help traders identify trends, reversals, and potential entry or exit points.

- Automated Trading: Many programs offer automated trading features, allowing traders to set predefined algorithms that execute trades based on specific market conditions. This feature can save time and remove emotional decision-making.

- Backtesting Capabilities: The ability to test trading strategies on historical data is invaluable. A program that supports backtesting allows traders to fine-tune their strategies before deploying them in real-time markets.

- User-Friendly Interface: A well-designed user interface can significantly affect your trading experience. Look for programs that offer intuitive navigation and customizable layouts.

Popular Forex Trading Programs

Here are some of the most popular forex trading programs available in the market today:

1. MetaTrader 4 (MT4)

MetaTrader 4 is undoubtedly one of the most widely used forex trading platforms globally. Its popularity stems from its comprehensive set of tools, including a robust charting system, a plethora of technical indicators, and the ability to create automated trading strategies through Expert Advisors (EAs). MT4 supports automated trading and boasts a large community of developers and traders sharing valuable resources.

2. MetaTrader 5 (MT5)

Building on the success of MT4, MetaTrader 5 introduces additional features, including more order types, an extended set of technical indicators, and access to other financial markets like stocks and commodities. MT5 is designed to cater to the needs of both novice and experienced traders while offering sophisticated tools for better analysis.

3. cTrader

cTrader is another popular forex trading platform known for its intuitive interface and advanced features. It offers high-speed trading, a wide range of technical analysis tools, and an integrated trading community. cTrader also allows traders to create their algorithms with cAlgo, providing a more personalized trading experience.

4. NinjaTrader

NinjaTrader is a robust trading platform geared towards active traders and futures trading. It provides advanced charting capabilities, market analysis tools, and various order types. NinjaTrader also allows for automated strategy development and backtesting, making it a favorite among technical traders.

Choosing the Right Forex Trading Program

Choosing the right forex trading program ultimately depends on your individual trading style and needs. Here are some factors to consider:

- Experience Level: Beginners might opt for user-friendly platforms, while advanced traders may seek more complex features.

- Market Focus: If you plan to trade other financial instruments besides forex, verify that the program supports those markets.

- Cost: Some trading platforms are free, while others require a subscription or commission fees. Always consider your budget when selecting a program.

- Customer Support: Reliable customer support can make a significant difference, particularly for new traders who may encounter challenges.

Importance of Continuous Learning

While using the right forex trading program can enhance your trading, continuous learning is equally important. Engaging with educational resources, webinars, and trading communities will help you stay updated with market trends and develop your skills over time. Furthermore, combining technical analysis software with fundamental analysis will yield deeper insights into market movements.

Conclusion

Forex trading programs play a crucial role in a trader’s success. By understanding the features, evaluating popular platforms, and considering personal needs, traders can optimize their experience. Remember to prioritize continuous learning and develop sound trading strategies to maximize your profitability in the dynamic forex market.