Resident which stays in a foreign nation therefore decide to create a present of possessions located in the United states? You’re casino Betfred review astonished to find out that the fresh You.S gift taxation regulations affect you, even though you are not a U.S. resident. Do not go into people deals if you don’t features totally know all the for example risks. To have Indians having assets overseas, the newest FAIU’s mandate is especially related. Non-revelation away from to another country assets otherwise investment could cause significant penalties, right back taxes, otherwise prosecution underneath the Black colored Currency (Undisclosed Overseas Income and you will Assets) and you will Imposition from Taxation Work, 2015. The fresh FAIU’s previous issuance of sees to Indian nationals having undeclared Dubai services is a note of the unit’s vigilance inside the scrutinizing overseas holdings.

Professionals of commercial home paying

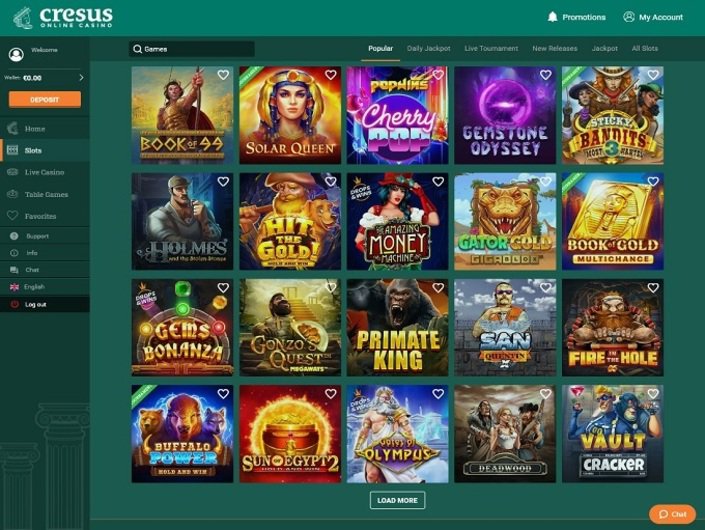

Investigation and fund is actually routed correctly and you can published immediately to ledgers, reducing person mistake. Effortlessly and conveniently spending book on the internet is to be the norm, for even growing property administration companies. Sure, as long as you are to try out during the one of many controlled web sites one to i recommend, on-line poker is safe for all of us professionals and your fee facts might possibly be secure. The a lot of time history of 15+ many years in the market and hard-gained reputation guarantees our very own whole review process of on-line poker websites is carried out on the maximum care and diligence.

Indian Income tax Residency Legislation: Very important Standards to possess Low-Residents

REITs tend to have large bonus payments since they’re expected to spend at the least 90% of the net gain to help you buyers. If the REIT fits so it demands, it does not have to pay corporate taxes. These types of thought guidance have shown a few control structures that may get rid of or eliminate You.S. house tax accountability on the USRP to own a non–U.S.

The pace and you may monthly payment will get to switch bi-annually based on the 30 day mediocre Protected Right away Funding Rate (SOFR), in addition to an excellent margin away from dos.75 percentage things that have a good 5% life time cap. All of our medical practitioner mortgage program also offers zero down payment to $1,000,100000, 5% off up to $step one,500,000, and ten% down as much as $2,100000,100. A doctor financing program does not costs people PMI (mortgage insurance rates). Concurrently, individual financing are perfect for organizations and LLCs, making it possible for individuals who choose to use inside entity labels to have tax advantages otherwise protection reasons to become recognized to possess services. This is an excellent choice, for example, to possess landlords which book several functions and want to become protected of almost any unexpected legalities. Called an appreciate-type change, it simply works for many who sell the brand new investment property and rehearse the fresh proceeds to purchase other equivalent assets.

See, such, Article 17(2) of your own Us–Uk income tax treaty. Concurrently, it does not connect with repayments managed while the deferred payment, which may be treated because the money out of work. A different firm one to pays desire should be an experienced citizen (under part 884) of the country of home to the payer’s pact to excused money out of income tax because of the foreign firm.

Northwest Lender *

Academy Bank has generated a top-tier Elite group Mortgage Program. With extensive experience in the loan career and you can a professional attention to your offering Medical professionals, Dentists, and various other Advantages, Cole Griggs leads how. Our union should be to give a seamless and professional feel to own all people, at the rear of him or her always. Need to be productive, authorized to train regarding the U.S, permit within the a status. No constraints/suspensions of any sort for every appropriate condition licensing website. Residents/fellows ought to provide evidence of a job in order to be eligible for this method.

Those people from organizations written or domiciled inside the a different nation try treated because the money out of international provide. An employee’s main work place (prominent office) is often the place where personnel spends a majority of their operating time. If you have nobody lay where all work date is actually invested, part of the jobs location is the perfect place where the efforts are founded, such where personnel reports to have performs or perhaps is if not expected to base what they do. The fresh GIIN you have to establish ‘s the GIIN assigned to the fresh FFI identifying their nation of home to have tax aim (or place of business if your FFI has no country of residence), except since the otherwise offered.

Simple tips to Play GG Poker 100percent free

Extraco are proud to possess supported regional Central Texans for more than 120 many years. When you like to financial having Extraco, you have made the fresh personalized service of a neighborhood bank in addition to technology and you may convenience of a nationwide bank. We are a nationwide collection lender within-family underwriting bringing smaller closings.Modifying members’ lifetime on the go to Financial Freedom try the purpose in the FAIRWINDS!

It third level create simply defense people employed in a home settlements and you can closings that disbursing money via 3rd-team accounts and you can excludes head transmits away from transferees to transferors and you can disbursements upcoming right from banking companies. There are numerous most other advantages to home-based a home to possess newbies and state-of-the-art investors the exact same. It’s an uncorrelated investment, and it also always continues to succeed actually through the market downturns.